Get Started With

servzone

Overview

Engaging in the business of selling liquor for the purpose of livelihood can be considered one of the most profitable occupations for the restaurant and hotel industry. This immediately increases the profit margin due to obvious reasons, ie high demand. However, obtaining a liquor license in India involves a lot of legal requirements and intricacies that the dealer has to go through. In addition, each state has its own framework through which they monitor the sale and consumption of alcohol. Every state has its own rules and laws governing alcohol.

In legal terms, a liquor license can be defined as the legal permission granted by the State Excise Department to those who wish to expand the boundaries of their business by distributing alcoholic beverages or drinks at a particular location Are ready. It is necessary for professional personnel to follow the rules and guidelines laid down by the officials of the state government.

Liquor license scope includes:

- Businesses engaged in selling liquor

- When and where liquor can be sold

- It also mentions the amount of alcohol sold

- Container sells liquor

- Types of alcohol served

- Cost of alcohol served

- One who can sell alcohol

- Information related to the manufacture and distribution of alcohol

Liquor license required

Obtaining a liquor license means that you have obtained legal permission to sell both alcohol and alcoholic beverages. It is necessary to obtain a liquor license before starting the business of manufacturing and distributing alcohol and alcoholic beverages. Engaging in the liquor trade without obtaining a liquor license is counted as a legal offense.

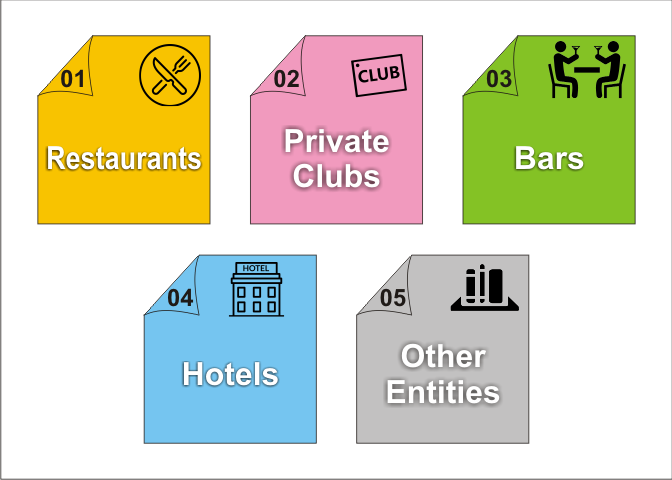

List of businesses applying for liquor license is as follows:

Documents Required for Obtaining Liquor License

- Identity proof of the applicant

- Address proof of the applicant

- Address proof the premise used

- NOC from the Fire Department

- NOC from Municipal Corporation

- Application with business details

- If an applicant is a company, list of directors

- If an applicant is a company, MOA and AOA

- Copy of latest Income Tax return

- Photograph of the authorized person

- An affidavit stating that the applicant has no criminal background

- An affidavit stating that the authorized person is not levnater when it comes to payment of dues

Guidelines

State Excise Department issues certain guidelines to maintain the quality of liquor that is being served to the end consumer. Following are the list of guidelines:

- Purchase liquor just from the approved alcohol shops.

- Any individual who isn't an Income Tax Payer can't get the liquor license.

- Any alcohol purchased from any military canteen is implied distinctly for the military personnel’s and not for the overall population.

- If the individual is making a trip starting with one state then onto the next, he should know the liquor possession limit of the travelling state.

- Any individual beneath the age of 21 isn't qualified to buy liquor. This breaking point can differ from state to state.

- Do not purchase alcohol unlawfully.

- Try not to serve liquor in any unapproved premises, as it is an illicit act.

- The license holder must show the cost of each brand of liquor served in the alcohol shop.

- Further, the menu rate list demonstrating the cost of alcohol served is compulsory for the disco, club, eateries and so on. In conclusion, no individual, regardless of whether male or female underneath the age of 21, ought to be utilized without compensation at wherever where the alcohol is served. This age breaking point can change from state to state.

Required Documents

- Applicant Identification Proof

- Address proof of the applicant

- The base of address proof used is

- NOC from Fire Department

- Municipal Corporation to NOC

- Application with business details

- If there is an applicant company, the list of directors

- If an applicant is a company, MOA and AOA

- Copy of latest income tax return

- Photo of authorized person

- An affidavit stating that the applicant has no criminal background

- When it comes to the payment of dues, the authorized person does not give an affidavit stating that

Guidelines

The State Excise Department issues certain guidelines to maintain the quality of alcohol served to the end consumer. The following is a list of guidelines:

- Buy liquor from approved liquor shops.

- Any person who is not an income tax payer cannot get a liquor license.

- Any alcohol purchased from any military canteen is implied distinctly for the military personnel’s and not for the overall population.

- If a person is traveling starting from one state, then he should know the liquor possession limit of the next travel state.

- No person under the age of 21 is eligible to purchase alcohol. This breaking point can vary from one state to another.

- Don't buy liquor illegally.

- Do not try to serve alcohol on any improper premises, as it is an illegal act.

- The license holder must indicate the cost of each brand of liquor in the liquor store.

- In addition, menu rate lists showing the cost of liquor for discos, clubs, eateries, etc. are mandatory. Finally, any person, whether under 21 years of age, male or female, wherever alcohol is served, should be used without compensation. This age breaking point can change from state to state.

Registration process

- Each state follows its own set rules and regulations regarding the purchase, sale and use of alcohol. Before applying for a liquor license, one must have complete knowledge of the liquor laws prevailing in that state. The State Excise Department is responsible for liquor laws. Any person desirous of obtaining a liquor license may inquire equally on the website of the State Excise Department, by going to the licensing authority or by going to the shops.

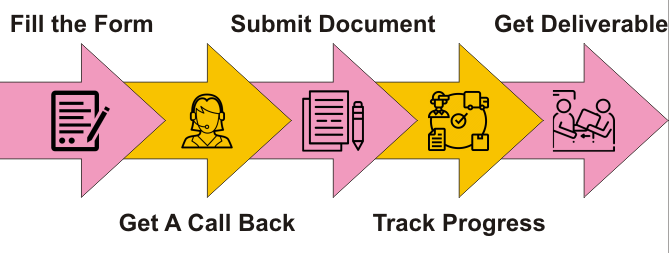

- Make sure you have a liquor license before you deal in the liquor business. Furthermore, it is important to state that obtaining a liquor license is a difficult process. Thus, it is prudent for you to contact an expert like servzone who will help you in the process of obtaining a liquor license.

- Liquor permit spending varies from state to state as state laws vary greatly in this concern. In addition, with some other data from the website of the state's excise department, there may be an idea without regard to the expense of liquor licenses.

- It is necessary for the applicant to file an application and provide important details therein. In addition, the applicant has to submit the application fee along with the application form to the concerned department.

- The applicant is required to provide all types of details, including the liquor license required by him. The description covers the following aspects of the business:

- Where the person wants to sell liquor, he is inside or outside the premises

- What type of wine he plans to serve, ie beer, wine, hard drink.

- The most widely recognized documents which are essential to submit include applicant’s identity proof, residence proof, address proof of the premise, Incorporation authentication, No Objection Certificate from fire department and Municipal Corporation, copy of the most recent Income Tax Return and Code Compliance Certificate.

- Applicant is also required to provide background information. Background information includes the following such as age, business experience, and personal record.

- After submitting the application form along with all the documents, the officials will start their processing by verifying the information given by you and if necessary can call for any further details.

- After confirmation, a notification will be posted by the concerned state authority announcing the candidate's proposed place of business and type of license, and so on. It is pertinent to mention that the proposed area of ​​the candidate should not be close to any temple, school, hospital and public park.

- After the notice is displayed, if the grievances are raised by the neighborhood persons within the recommended period, at that time it will be reported to the concerned office. It is important to mention that the candidate has the option to protect himself. In the event that, with no complaints, the situation will proceed by assessing the application.

Validity

The liquor license is valid for one year, that is, it is legally required to renew it annually, and this means that the renewal fee is to be paid every year. Any person who is required to renew his license is required to apply for the equivalent thirty days before the date of expiry along with payment of renewal fee. Submit the application form along with the copy of the challan, the proof of the installment of the usage fee of twenty five rupees and the liquor license renewal fee prescribed by the state government every once

.

Cancellation

The state excise authorities have the power to revoke the license in the event of encountering one of the following events:

Fees

The cost of obtaining a liquor license varies from state to state. Following are the different types of costs to be paid during the process of obtaining a liquor license:

- Temporary liquor license cost

If alcohol is served at weddings, occasions or gatherings in a small town where the population is less than two million. Right now, if more than 100 persons and less than 100 persons are below Rs. 7,000, the liquor permit will be ten thousand rupees.

- Liquor license cost for private party in resort or flat

As per Excise Department rules, FL-4 license is required to obtain liquor in a private flat or resort in a sorted gathering.

- Liquor license cost in permit rooms

This Serving Liquor License cost in Permit Room is rupees five lakh forty-4,000 though, for a café and brew shop this permit costs rupees one lakh fifty thousand.

- Liquor license costs for the state

The candidate is required to submit the application expense along with the application form. The fees for liquor permits range from Rs 5,000 to fifteen thousand rupees or more. Also, according to major state laws the application fee is contrary from state to state.

How Servzone will help you?

GST Registration

PVT. LTD. Company

Loan

Insurance